Balance Transfer Credit Cards Guide

Balance transfer credit cards can save you £1,000s on your outstanding credit card debt. Read our guide for tips, frequently asked questions (FAQs) and how to compare balance transfer cards.

What is a 0% balance transfer credit card?

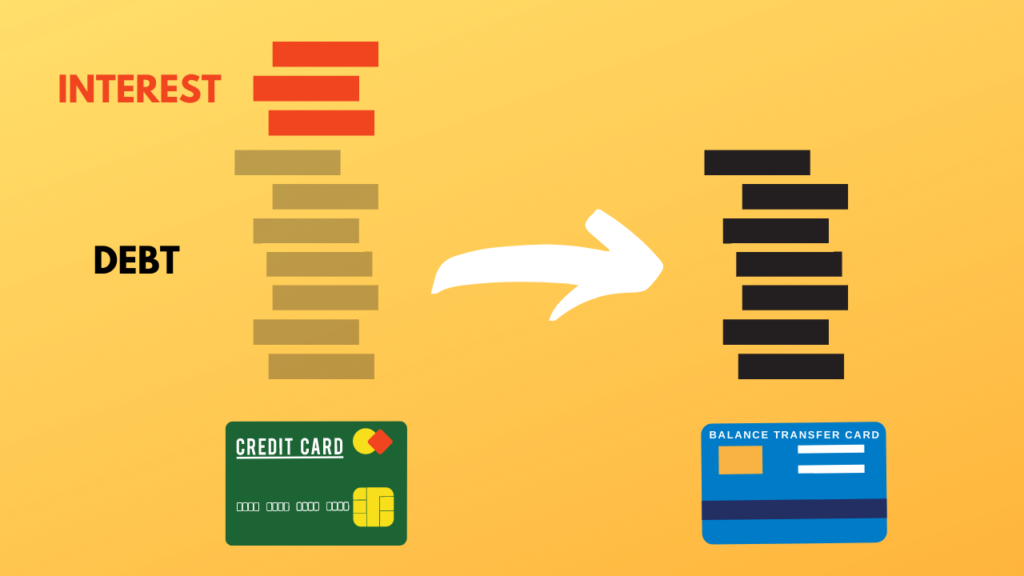

0% balance transfer credit cards are designed to help you pay off high-interest credit card debt. This is done by moving the balance from your old card to a new balance transfer card with 0% interest. This 0% interest rate lasts for a set period of time, sometimes up to 36 months.

Meet the minimum monthly repayments and you will repay the original debt each month, rather than just chip away at the interest. This is why balance transfer cards can be a great way to pay off your debt quickly.

What is a credit card balance transfer?

Credit card balance transfers are a method of paying off existing credit card debt by transferring debt onto a different card. This different card will have a much lower or even 0% interest rate.

If you have built up a significant amount of debt on your credit card, your minimum monthly payments may only cover the interest. This is why 0% balance transfer cards can be such a great option, as you’ll be paying off your debt each month, not just the interest!

If you’re looking to clear debt fast, balance transfer credit cards might be your best option.

How to transfer credit card balance

Transferring a balance from one credit card to another is straightforward. We have outlined the steps below:

1. Evaluate your credit card debt

Before deciding to transfer your credit card balance, take stock of how much debt you have. Calculate your total debt, figure out which credit cards are charging the most interest and set a target for how much you want to pay off and by when.

2. Choose your balance transfer credit card

Compare balance transfer credit cards: get quotes and decide which is best for you. We will show you how later on in this guide.

3. Time to apply for a balance transfer card

Now that you’ve worked out which card is right for you, apply for that card via an online application. Your financial history and credit rating will affect whether or not you are approved and how good the deal will be for you. For example, whether you’ll receive the balance transfer limit you want.

Remember to continue to make the minimum repayments on your existing credit card in the meantime!

4. Pay off your debt

When you apply for your balance transfer card, you will be asked to provide information on cards you wish to pay off and how much you wish to transfer. This means if you are successful in your application your debt will automatically transfer to your new credit card.

Make sure you know how long the 0% or low-interest period lasts as you’ll want to pay off as much debt as you can during this time.

How much does a credit card balance transfer cost?

Balance transfers aren’t free unless you get a no-fee 0% balance transfer credit card (more on that later). Most balance transfer cards charge a small fee when you transfer your debt onto the card.

The balance transfer fee typically costs between 1% and 5% of the amount you transfer. This fee will simply be added to your total balance on the card and can be paid off in your monthly repayments. The balance transfer fee will remain interest-free throughout the introductory period.

For example, if you transfer £1,000 to a card with a 2% balance transfer fee, this would cost £20. Therefore, the total transferred balance would be £1,020.

What are the best balance transfer credit cards?

In order to decide which balance transfer credit card is best for you, there are a few things you need to consider…

- Interest rate - How long does the promotional 0% interest period last? And what’s the standard interest rate once this period ends?

- Balance transfer limit - Most cards have a limit on how much you can transfer onto your new card and your credit score can affect this.

- Balance transfer fee - Make sure the balance transfer fee doesn’t offset any savings you are making on the low-interest rate. If the fee is as high as 5% and you are transferring a large balance, this could add up.

Everyone’s circumstances are different and it really depends on your situation as to which balance transfer is the best for you.

For example, if you think you can pay off your balance in a short amount of time, then it might be worth picking a balance transfer credit card with a short 0% period. This is because 0% balance transfer cards with a long introductory period can have higher balance transfer fees. If you are planning on paying off your balance before the 0% period ends, then it won’t be worth the extra expense for a longer 0% period!

Make sure you use an eligibility checker before deciding which balance transfer card is best. This will allow you to set your expectations as you’ll know what you are likely to be accepted for.

Should I get a balance transfer credit card?

Balance transfer credit cards are for people who have existing credit card debt and are looking to cut the interest rate in order to pay off what they owe quicker.

If the balance transfer fee isn’t too high for you and the introductory 0% interest rate lasts long enough, then a balance transfer could save you a lot of money. Make sure you weigh up the pros and cons to decide whether transferring your balance suits your situation.

Soon enough, your old credit card debt will be a thing of the past!

Pros of balance transfer credit cards

- Pay off outstanding credit card debt at 0% or low-interest rate

- Save money whilst paying off your debt

- Pay off your debt quicker than you would be able to on your old credit card

- Manage all of your debt repayments on one card rather than multiple credit cards, making it easy to focus on the end goal

Cons of balance transfer credit cards

- You might need a strong credit score to qualify for the 0% or low-interest rate period

- Balance transfer fees can add up if not managed

- If you don’t make the minimum monthly repayments, you’ll lose the 0% interest period

- If you don’t clear the debt during the interest-free period, then you might end up paying fees and a higher interest rate than you were before

3 balance transfer credit card top tips

1. DON’T forget about the 0% end date

The main benefit of balance transfer credit cards is that you won’t have to pay any interest on your balance for the first 12-36 months (depending on the agreement). Once this interest-free period ends, the interest rate will revert to the same rate you were paying on your old credit card or even higher.

Reap the benefits of the balance transfer card and pay as much of your transferred debt as possible before the 0% interest rate ends.

2. Repay the monthly minimum (aim for more)

That 0% interest rate won’t last long if you fail to make the minimum monthly payments on your balance transfer card. Your credit card provider will likely withdraw the 0% deal or hit you with expensive penalties if the monthly minimum payments aren’t met.

Set up a direct debit for the maximum monthly amount you can afford before the interest-free period ends. This way, you won’t have to worry about forgetting!

Pay more than the minimum each month to cut your debt. Minimum repayments only make the debt last longer.

3. NEVER spend or withdraw cash on your balance transfer card

Balance transfer cards work exactly like normal credit cards. You can make purchases, transfer money and withdraw cash on them. However, just because you can do something, doesn’t mean you should.

This is because you can be hit with huge fees if you spend or withdraw cash using a balance transfer card. The 0% interest rate usually doesn’t apply to shopping and it may add to your debt.

Compare balance transfer credit cards

Coming soon.

Best 0% balance transfer credit cards

Coming soon.

FAQs