Motoreasy GAP insurance Discount Codes May 2024

Find working voucher codes, sales & offers

Get 20% off Policies for MotorEasy Warranty Insurance at Motoreasy GAP insurance

Free MOT with Full Manufacturer's Service with MotorEasy Warranty Insurance at Motoreasy GAP insurance

Save 10% on Extended Car Warranty at Motoreasy GAP insurance

£25 off Car Service Plan Orders at Motoreasy GAP insurance

Get 11% off Orders with MotorEasy GAP Insurance

Save 11% on MotorEasy GAP Insurance Policies

Save 10% on Car Warranties with MotorEasy Warranty Insurance at Motoreasy GAP insurance

Get 10% off Orders with MotorEasy Warranty Insurance at Motoreasy GAP insurance

Get 15% off Policies by Adding This GAP Insurance Code at Motoreasy GAP insurance

Save 10% on Orders with MotorEasy Warranty Insurance at Motoreasy GAP insurance

Save 15% on Orders with MotorEasy GAP Insurance

Get 11% Discount on Your MotorEasy Warranty Insurance Policy at Motoreasy GAP insurance

Get 11% off Your MotorEasy GAP Insurance Policy

Get 10% off Cosmetic & Alloy Repairs with GAP Insurance at Motoreasy GAP insurance

Free MOT with Car Warranty Bundle at Motoreasy GAP insurance

Save 10% on MotorEasy Warranty Insurance at Motoreasy GAP insurance

20% off GAP Insurance Bundle at Motoreasy GAP insurance

Get an 11% Discount on Alloy Wheel Insurance at Motoreasy GAP insurance

Save 11% on Orders with This GAP Insurance Discount at Motoreasy GAP insurance

Get 20% off Your Policy with This GAP Insurance at Motoreasy GAP insurance

Get 11% off Cosmetic Repair Insurance with MotorEasy Warranty Insurance at Motoreasy GAP insurance

Get 11% off Policies with MotorEasy GAP Insurance

Get 10% off Car Cover Quote with MotorEasy Warranty Insurance at Motoreasy GAP insurance

11% off Car Warranty Policy Orders at Motoreasy GAP insurance

5% off Tyre Insurance Policy Orders at Motoreasy GAP insurance

11% off Cosmetic Repair Insurance Policy Orders at Motoreasy GAP insurance

11% off GAP Insurance Policy Orders at Motoreasy GAP insurance

11% off Cosmetic Repair Insurance Policy Orders at Motoreasy GAP insurance

£10 off 2 or 3 Selected Hankook Tyres Orders at Motoreasy GAP insurance

£20 off 4 Selected Hankook Tyres Orders at Motoreasy GAP insurance

| 🥇 Best Discount | £25 Off |

| 🏷 Voucher Codes | 31 |

| 🕰️ Most Recent | 14 May 24 |

- About Motoreasy GAP insurance

- Why is my Motoreasy GAP insurance Discount Code Not Working?

- Alternatives to Motoreasy GAP insurance

- Tips for Finding the Best Motoreasy GAP insurance Codes

- What Products Does Motoreasy GAP insurance Sell?

- Motoreasy GAP insurance Reviews

- What To Think About Before Buying at Motoreasy GAP insurance?

- All retailers

- Motoreasy GAP insurance Voucher Code

The most popular Motoreasy GAP insurance vouchers for May 2024

| Voucher Code Description | Discount Type | Likes |

|---|---|---|

| Exclusive 11% off GAP Insurance at MotorEasy | Voucher | 1 |

| Get 20% off Policies for MotorEasy Warranty Insurance | Voucher | 1 |

| Free MOT with Full Manufacturer's Service with MotorEasy Warranty Insurance | Voucher | 2 |

| Save 10% on Extended Car Warranty | Voucher | 1 |

| £25 off Car Service Plan Orders | Voucher | 1 |

| Get 11% off Orders with MotorEasy GAP Insurance | Voucher | 1 |

About Motoreasy GAP insurance

Motoreasy GAP Insurance is a top insurance provider known for delivering exceptional car protection solutions. They specialise in providing GAP insurance, which bridges the financial ‘gap’ between the actual cash value of a vehicle and the amount still owed on it. Motoreasy has created a reputation for offering comprehensive, straightforward, and cost-effective insurance solutions that provide peace of mind. Their product might be of great benefit in the unfortunate event of a car being written off or stolen. With a range of cover options available, they strive to cater to the diverse needs of their customer base. Browse the latest Motoreasy GAP insurance deals and discount codes at Latest Deals to save money on your next purchase.

Why is my Motoreasy GAP insurance Discount Code Not Working?

There are several factors which might be hindering the working of your Motoreasy GAP insurance discount code.

- The voucher code may have expired: It is essential to note the validity of the Motoreasy GAP insurance voucher code you are utilising. If its validity has passed, then the voucher cannot be applied.

- The discount code may not be applicable to your purchase: The Motoreasy GAP insurance discount code might not be compatible with the insurance policy you're purchasing, as some codes are directed towards specific policies. Make sure to verify that your selected policy meets the criteria of the promo code.

- The discount code may have been entered incorrectly: If you input the Motoreasy GAP insurance discount incorrectly, including any symbols, digits, or letters, it could cause the code to malfunction. It's always a good practice to double-check the entered code.

- The discount code may not be valid for your region: Motoreasy GAP insurance might restrict some codes to particular regions or countries, so it's crucial to verify that your discount code is valid where you are.

It's always recommended to read the terms and conditions of any promo codes to avoid any misunderstandings.

Alternatives to Motoreasy GAP insurance

- ALA - As a leading provider of GAP Insurance in the UK, ALA Insurance offers comprehensive coverage options that are comparable to Motoreasy's offerings.

- Direct Gap - Direct Gap is another recognised provider of GAP insurance in the UK. Their policies cover a wide range of vehicles and cater to a variety of consumer needs.

- Admiral - A prominent insurance company in the UK, Admiral offers a GAP insurance policy which might meet your needs. They are known for competitive rates and good customer service.

- Insure The Gap - This firm specialises in GAP insurance policies for both new and used cars, providing an alternative UK retailer for GAP coverage.

- Auto Trader - Better known for buying and selling vehicles, Auto Trader also offer competitive GAP insurance to cover financial shortfalls in case of accidents or theft.

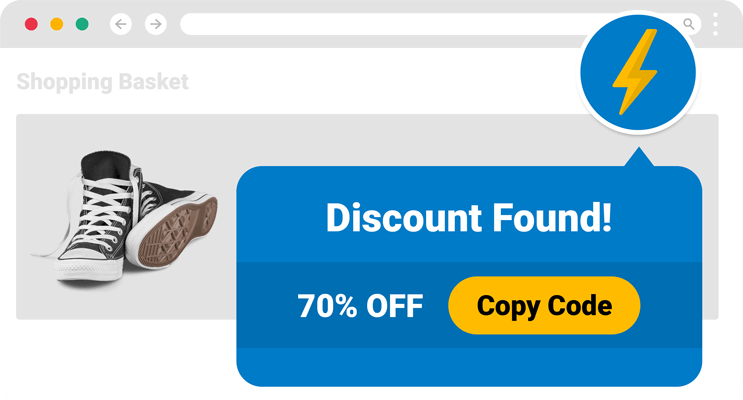

Tips for Finding the Best Motoreasy GAP insurance Codes

Saving money on Motoreasy GAP insurance can be a breeze if you're applying a few cost-effective strategies. Firstly, consider comparing the rates from different insurers before making any commitment. Be sure to evaluate the level of coverage you require, as over-insuring your vehicle can lead to unnecessary costs. It's also a good idea to evaluate your payment options, as installing payments may be more feasible for some. However, the easiest way to save on your Motoreasy Gap insurance is by visiting LatestDeals.co.uk. We provide a selection of discount codes and promotional offers, both for Motoreasy and many other retailers. So, don't miss out on the chance to get the best deal on your insurance cover. Simply head to our site, type "Motoreasy GAP insurance" into the search bar, and let us find the best deals for you.

What Products Does Motoreasy GAP insurance Sell?

- Vehicle GAP Insurance: Motoreasy provides GAP insurance for both new and used vehicles to cover the financial gap in case your car is declared a write-off.

- Combined GAP Insurance: Motoreasy combined GAP insurance provides coverage for the difference between the market value and either the amount you paid or the outstanding finance, whichever is highest.

- Lease GAP Insurance: If you lease your vehicle, Motoreasy offers Lease GAP insurance to protect you against the shortfall that could occur if your leased vehicle is written off.

- Motorbike GAP Insurance: Motoreasy caters to motorbike owners as well with specialised GAP insurance that covers any potential financial gap.

- Extended Warranty Cover: Besides GAP insurance, Motoreasy provides an extended warranty cover to save you from unexpected repair costs.

- MOT Insurance: Motoreasy’s MOT insurance can offer you coverage against the cost of repairing or replacing specific parts to pass your MOT test.

- Vehicle Service Plans: Motoreasy also offers comprehensive vehicle service plans ensuring your vehicle remains in its best condition without any surprising costs.

What To Think About Before Buying at Motoreasy GAP insurance?

- Quality of Service: Before purchasing Motoreasy GAP insurance, consider the quality of their service. Look for customer reviews and positive testimonials that demonstrate they deliver on their promises.

- Cost Analysis: Determine how much you are willing to pay for GAP insurance. Compare the cost of the Motoreasy GAP insurance with other similar products to ensure you are getting a good deal.

- Inclusions and Exclusions: Make sure to look into the details of what the Motoreasy GAP insurance covers. Not every policy covers the same things, so it's important to understand exactly what you're buying.

- Claim Process: Consider the claim process provided by Motoreasy. Is it straightforward? If you need to make a claim, you want the process to be as simple as possible.

- Customer Support: Examine the level of customer support Motoreasy provides. Is there a dedicated customer service line you can reach if you have questions or concerns?

- Policy Duration: Check the duration of the Motoreasy GAP insurance policy. Different policies can have different lengths, so it's good to know how long you'll be covered.

- Terms and Conditions: Read the terms and conditions in detail before purchasing. It's crucial to understand the company's rules and regulations to avoid any potential complications.

- Company Reputation: Check out the reputation of Motoreasy as a provider of GAP insurance. Are they viewed favourably in the industry?

- Cancellation Policy: Research and understand the cancellation policy of Motoreasy GAP insurance. In case you need to cancel the insurance, it's important to know the process and any associated fees.

- Competitor Comparison: Compare Motoreasy’s offerings, prices, and customer experiences with other GAP insurance providers. This helps to ensure you’re choosing the most appropriate and cost-effective plan.