- All retailers

- Good To Go Insurance Voucher Code

Good To Go Insurance Discount Codes April 2024

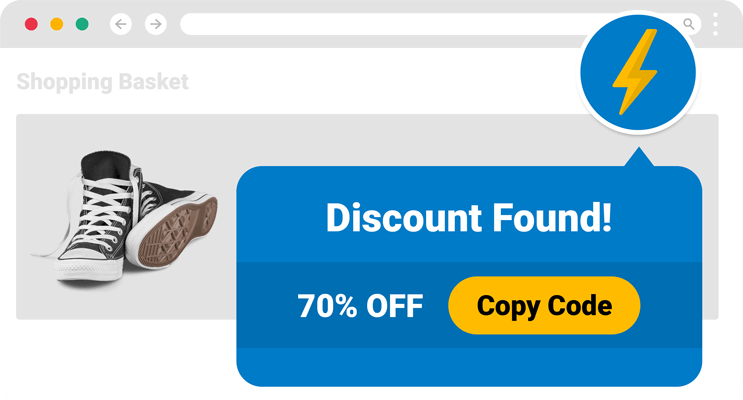

Find working voucher codes, sales & offers

Find the latest Good To Go Insurance discount code, sales and savings for April below - powered by our community of over 3 million bargain hunters. Promo not working? We're really sorry but let us know and you can earn free gift cards!

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

10% off Travel Insurance at Good To Go Insurance

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Good to Go Travel Insurance 10% Discount Code at Good To Go Insurance

Good to Go Travel Insurance 20% Discount Code at Good To Go Insurance

| 🥇 Best Discount | 20% Off |

| 🏷 Voucher Codes | 10 |

| 🛍️ Deals | 0 |

| 🕰️ Most Recent | 19 Apr 24 |

- About Good To Go Insurance

- Why is my Good To Go Insurance Discount Code Not Working?

- Alternatives to Good To Go Insurance

- Tips for Finding the Best Good To Go Insurance Codes

- What Products Does Good To Go Insurance Sell?

- Good To Go Insurance Reviews

- What To Think About Before Buying at Good To Go Insurance?

The most popular Good To Go Insurance vouchers for April 2024

| Voucher Code Description | Discount Type | Likes |

|---|---|---|

| Goodtogo Insurance 10% Discount Code | Voucher | 1 |

| Good to Go Travel Insurance 10% Discount Code | Voucher | 2 |

| Good to Go Travel Insurance 10% Discount Code | Voucher | 1 |

| 10% off Travel Insurance | Voucher | 1 |

| Good to Go Travel Insurance 10% Discount Code | Voucher | 2 |

| Good to Go Travel Insurance 10% Discount Code | Voucher | 1 |

About Good To Go Insurance

Good To Go Insurance is a reputable online insurance provider based in the UK, specialising in travel insurance solutions tailored to meet the needs of every individual or family. It offers a range of insurance packages that cater to various travel needs, from single trips to multi-trip insurance policies, including cover for over 50s, and those with pre-existing medical conditions. Good To Go Insurance prides itself in providing comprehensive coverage at competitive prices, enabling travellers to embark on their journeys with peace of mind. Customers can conveniently obtain a quote and purchase their insurance online, with support available whenever required. Be sure to check for the latest Good To Go Insurance discounts and promo codes at Latest Deals to save on your next travel insurance purchase.

Why is my Good To Go Insurance Discount Code Not Working?

Just like with Argos, there might be a few reasons why your discount code for Good To Go Insurance isn’t working:

- The voucher code may have expired: Always verify the expiration date of the Good To Go Insurance voucher code. It could be the case that it has already expired, hence proving ineffective.

- The voucher code might be inapplicable to your purchase: Every promo code comes with its own terms and conditions, including being applicable only to specific insurance packages or policies. It's crucial to ascertain that your chosen policy satisfies all stipulations set forth by Good To Go Insurance.

- The voucher code might have been inputted incorrectly: Recheck that you have put in the voucher code accurately. It's possible that a small mistake in entering the promo code is resulting in it failing to work.

- The voucher code may not work in your region: It’s not uncommon for some promo codes to be valid only for certain regions. Make sure the Good To Go Insurance promo code is available for use in your geographical area. By addressing these potential issues, you stand a better chance of saving money on your insurance policies!

Alternatives to Good To Go Insurance

- Compare The Market - As a popular insurance comparison website in the UK, Compare the Market offers a platform to compare insurance quotes from various providers, including potentially alternative options to Good To Go Insurance.

- Go Compare - GoCompare is another top insurance comparison site that offers alternatives to Good To Go Insurance, providing quick and easy comparison of quotes for different insurance products.

- MoneySupermarket - MoneySuperMarket is a well-known British company known for providing a comparison of insurance providers and their policies, acting as a good reference point for alternatives to Good To Go Insurance.

- Confused - This online insurance broker helps UK consumers find and compare insurance quotes from a multitude of providers, offering a variety of alternatives to Good To Go Insurance.

- Direct Line - As well as their own coverage, Direct Line provides various other insurance products, making them a possible alternative to Good To Go Insurance for some customers.

- Aviva Car Insurance - As the UK's largest insurance provider, Aviva offers an enormous range of insurance services that might provide favourable alternatives to Good To Go Insurance.

- Admiral - Known for their multi-car insurance, Admiral also offers a range of other policies which customers may see as alternatives to Good To Go Insurance.

Tips for Finding the Best Good To Go Insurance Codes

There are several tactics you can use to save money when taking out a policy with Good To Go Insurance. First, consider using their online quote comparison tool, which can help you to compare prices of various policies and ensure you're getting the best deal. Second, they often offer online exclusive discounts, so it's always worth checking their web site before committing to a policy. Third, you should look for Good To Go discount codes here on Latest Deals and apply them on checkout to reduce your premium. Fourth, you could save more by choosing a policy with a higher voluntary excess - but make sure it's a cost you're willing and able to bear if you need to make a claim. Lastly, consider what add-ons you truly need: things like personal accident cover or breakdown cover may not be necessary if you already have them elsewhere, so be sure to tailor your coverage to your needs to avoid paying for unnecessary extras.

What Products Does Good To Go Insurance Sell?

Car Insurance: Good To Go Insurance provides comprehensive car insurance policies to meet your individual needs and budget. They offer cover for legal costs, accidental damage, theft, fire, and windscreen damage.

Home Insurance: Good To Go Insurance also offers home insurance products to protect your home and its contents from loss, damage, or theft. They provide different levels of cover to suit your specific requirements.

Travel Insurance: Good To Go Insurance specialises in providing tailored travel insurance policies. Their travel cover includes medical expenses, overseas cover, personal accidents, and even cancellation policies.

Motorbike Insurance: Good To Go Insurance offers personalised motorbike insurance. From third-party, fire and theft coverage to comprehensive protection, they ensure that you have the peace of mind you need while on the road.

Pet Insurance: Good To Go Insurance provides pet insurance plans to cover potential vet expenses. Their policies can be customised to cover things like emergency vet fee, accidental injury, theft or straying, and much more.

Gadget Insurance: Good To Go Insurance offers gadget insurance plans to protect your mobile phones, tablets, laptops, and other gadgets. They provide cover for accidental damage, theft, and even liquid damage.

Van Insurance: Good To Go Insurance offers comprehensive van insurance policies. They provide cover for accidental damage, theft, fire, and even windscreen damage.

Landlord Insurance: Good To Go Insurance offers insurance policies to protect landlords' properties. Their coverage includes buildings and contents insurance, legal expenses, and rent guarantee insurance.

What To Think About Before Buying at Good To Go Insurance?

- Insurance Policies: Review the various insurance policies that Good To Go Insurance offers. Understand what each policy covers and determine if it fits your specific needs.

- Policy Cost: Examine the cost of each policy offered by Good To Go Insurance. Ensure the policies are within your budget and the cost is justified by the coverage offered.

- Claim Process: Understand the claim process of Good To Go Insurance. Check out their guidelines for making a claim and their history of dealing with claims.

- Customer Reviews: Investigate customer reviews of Good To Go Insurance. This will help you understand the company's reliability and the quality of their customer service.

- Customer Support: Assess the customer support provided by Good To Go Insurance. Confirm that they provide easy access to assistance, be it through phone, email or live chat.

- Payment Options: Observe the payment options provided by Good To Go Insurance. Verify that they offer a variety of payment methods, such as credit card, direct debit, or other payment methods.

- Renewal Process: Check how the policy renewal process works with Good To Go Insurance. It's essential to have a simple and straightforward process for continuing your coverage.

- Policy Details: Read the policy documents thoroughly. Ensure to understand the terms and conditions, exclusions, and any extras or add-ons included in the policy.

- Financial Stability: Explore the financial stability of Good To Go Insurance. A strong financial base is a good indicator that the company can pay your claims.

- Comparison with Other Insurance Providers: Compare the coverage and pricing offered by Good To Go Insurance with other insurance providers. Doing so helps ensure you are getting the best value for your money.